fanduel tax rate|States bet on boosting taxes for online sports betting companies : iloilo The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit pa Megan Mariiiee, megmariiee, Megan Marie, meggyeggo, megomyeggos Nudes, Megan Mariiiee Naked Photos and Clip from Onlyfans, Patreon, Snapchat, Manyvids, Instagram .

fanduel tax rate,We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing . Tingnan ang higit pa

FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced . Tingnan ang higit pa Getty. Table of Contents. Are There Taxes or Fees on Sports Betting? DraftKings Sports Betting Taxes. FanDuel Sports Betting Taxes. How States Tax Legal . If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non . FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out . 1. Income Tax. Because gambling winnings are considered taxable income, they have the same rates as other types of income. OVERVIEW. Fantasy sports leagues can yield hefty winnings if Lady Luck smiles on you. If you win big—or even not so big—you'll need to save a portion of that . Despite the enormous sums, FanDuel didn’t question the source of Patel’s funds until late 2022, his lawyer, Alex King, told Reuters. Patel’s annual salary was less .

The new tax rate in Illinois could prompt DraftKings and FanDuel to take steps including pulling back on local marketing and promotion deals, according to an . FanDuel Key Statistics. FanDuel generated $3.23 billion revenue in 2022, a 62% increase on the previous year; $29 billion was wagered on FanDuel in 2022, more .fanduel tax rate States bet on boosting taxes for online sports betting companies By Kevin Spain. @kevin_spain. February 14, 2024 12:19pm. Fact Checked by Blake Weishaar. Arizona state tax on gambling winnings for individuals ranges from 2.59% to 4.50%, and that's regardless of whether you're sports betting in Arizona, playing at casinos or betting on horses. First Bet Safety Net up to $1,000 in Bonus Bets.When winnings exceed $5,000, payers generally must withhold income tax at the 25% rate. Tax withholding, if any, is shown on Form W-2G. Comps. Taxpayers who gamble frequently enough and in such high amounts that complimentary items (such as tickets to shows, etc.) are provided to them by casinos are required to include these “comps” in income. FanDuel recommended a tax reduction to 35%, according to Legal Sports Report, saying a more competitive rate would lead to an estimated $350 million-plus in additional total gross revenue over a . 19c for each $1 over $18,200. $45,001 – $120,000. $5,092 plus 32.5c for each $1 over $45,000. $120,001 – $180,000. $29,467 plus 37c for each $1 over $120,000. $180,001 and over. $51,667 plus 45c for each $1 over $180,000. The above rates don't include the Medicare levy of 2%.

A user accesses the mobile FanDuel sportsbook. Business Wire via Associated Press. New York has reaped the rewards of mobile sports betting, but operators warn that the state's high tax rate could .States bet on boosting taxes for online sports betting companies Ten to 12 operators would see an online sports betting tax rate of 50%; 13 to 14 operators a 35% tax rate; and 15 or more operators would see a tax rate of 25%. Both also urged the legislators to .

fanduel tax rate Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through .

Effective for tax years after 2017, the federal withholding rate for gambling winnings of $5,000 or more is 24%. That’s a cumulative amount for the entire year, so even if you win $1,000 on five or more separate occasions during the year, you still need to report your winnings. Sportsbooks and the Tennessee lottery typically withhold 25% of . Note: NY legislators passed a budget proposal in April 2021 that will raise the state income tax rate to 9.65% from 8.82% for single filers making over $1 million and joint filers earning more than $2 million. Rates will rise even higher for NY residents who make more than $5 million and $25 million per year. As for local taxes, New York City .

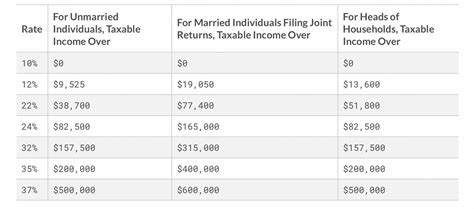

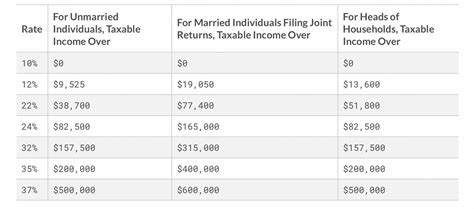

This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021. For casual gamers, on the other hand, Fanduel winnings are more akin to lottery winnings and .

Calculate Total After Taxes. You Keep From Your Gambling Winnings. $ 0. Note:Tax calculator assumed a standard deduction of $12,400 (single)/$24,800 (married) and does not include any municipal/local taxes. .

You may have access to our apps FanDuel Racing or TVG depending on where you wager. . As of July 9th, 2017 the Illinois personal income tax rate is 4.95%. Any wager which results in proceeds of more than $5,000.00, is subject to reporting and withholding if the amount of such proceeds is at least 300 times as large as the amount wagered . How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel . The FanDuel Group, which includes FanDuel, the online arm of Bally’s, BetMGM, and DraftKings . Though he notes that “no one’s happy with a 51% tax rate,” New York is a “huge state and .© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. FanDuel President Christian Genetski said the state is not growing its handle or customer base at the same rate as other states. "In New York, operators sprinted out of the gate with generous customer bonusing but once operators understood how the customer bonuses were being taxed and it became evident that no tax relief was . As FanDuel covers only federal taxes, you’re responsible for any state and local taxes. New York , for instance, has one of the highest combined state and local tax rates in the US at 8.82%. Conversely, in California , the state tax rate is a slightly more manageable 7.25%.

Every gaming operator, such as FanDuel Massachusetts is obligated to issue you a Form W-2G if you win $5000 or greater. If for some reason you don’t get the form, contact the casino as they should have a copy. . The tax rates are the same as rates on ordinary federal gross income whether the gambling winnings were from in .

fanduel tax rate|States bet on boosting taxes for online sports betting companies

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes

PH2 · Tax Considerations for Fantasy Sports Fans

PH3 · States bet on boosting taxes for online sports betting companies

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Online

PH6 · How Much Taxes Do You Pay On Sports Betting?

PH7 · How Much Are FanDuel Winnings Taxed?

PH8 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & L

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH10 · FanDuel Revenue and Usage Statistics (2024)